Washington, DC—

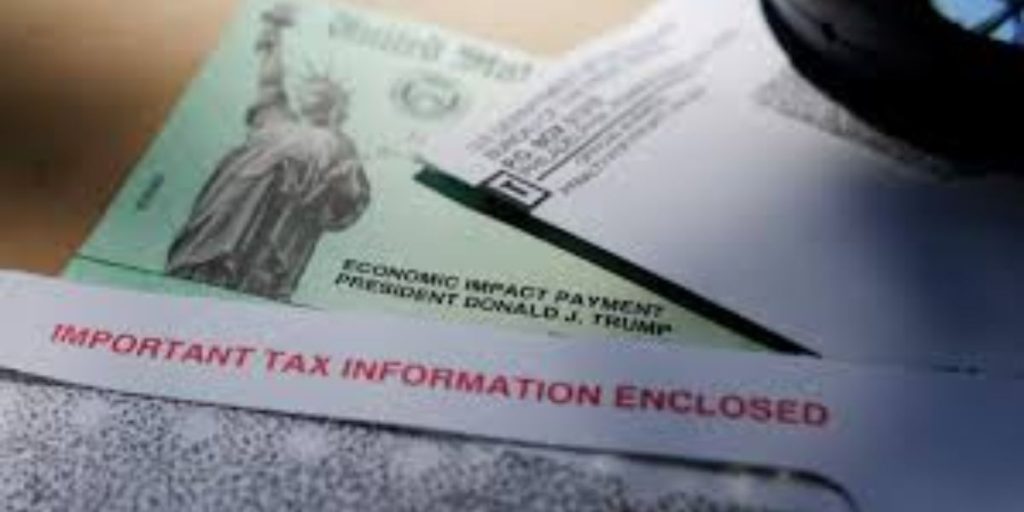

In a continuation of their ongoing efforts to assist taxpayers, the Internal Revenue Service (IRS) has announced that eligible individuals who did not claim the Recovery Rebate Credit on their 2021 tax returns would be sent automatic payouts later this month.

Reviewing internal data revealed that many qualified taxpayers filed a return but failed to claim the credit; thus, the IRS disclosed the additional step. People who did not get any stimulus payments—also called Economic Impact Payments (EIPs)—can get their money back through the Recovery Rebate Credit.

The payments will be sent out automatically in December and, in most circumstances, should arrive by late January 2025, so qualified taxpayers don’t need to do anything to get them. Payments will be delivered to qualifying taxpayers either through direct deposit or paper check. A separate letter will also be sent to advise them of the payment.

According to IRS Commissioner Danny Werfel, “the IRS continues to work hard to make improvements and help taxpayers.” As an illustration of our dedication to exceeding taxpayer expectations, these payments are being made.

Our analysis of internal data revealed that out of one million taxpayers who were entitled for this complicated credit, none of them claimed it. These payments will now be automatic, so qualified taxpayers won’t have to go through the hassle of submitting an amended return to get them. This should reduce administrative burden and get the money to those who deserve it.

There are a lot of variables that affect the payments, but the most any one person may get is $1,400. Payments expected to be disbursed amount to around $2.4 billion.

Anyone who hasn’t yet done their taxes for 2021 may be entitled for this credit or any other refund that may be due, but they have until April 15, 2025, to do so, according to the IRS.

Claimants for the credit currently outnumber those who were qualified.

We have already sent out Recovery Rebate Credits and EIPs to the vast majority of taxpayers who were qualified for them.

If a taxpayer’s eligibility for the 2021 Recovery Rebate Credit is determined by IRS data, only then will they get the December installments for the credit. Individuals who were eligible for the Recovery Rebate Credit but either left the field blank or entered $0 when filing their 2021 tax return are considered qualified.

An explanation of automatic payments

If you are eligible for this credit but did not claim it on your 2021 tax return, you should get your money by the end of January 2025. If the taxpayer’s bank account or record address is on file for 2023, that’s where the money will be delivered.

Three Final Options to Get Social Security Payments Before 2025

These 2021 Recovery Rebate Credit payments will be provided to the taxpayer in the form of an IRS letter. Nobody needs to do anything if the taxpayer has closed their bank account since submitting their tax return for 2023. Following the return of funds to the IRS, the refund will be sent back to the record-keeping address by the bank.

Read the 2021 Recovery Rebate Credit Frequently Asked Questions and Answers for details on eligibility and payment calculation.

The credit could be claimable by taxpayers who did not submit a return for 2021 but who do so in the future.

Anyone who hasn’t turned in their 2021 taxes yet but is still hoping to get a refund can do so until April 15, 2025, if they file and claim the Recovery Rebate Credit.

Even if there was little or no income from a job, business, or any other source, eligible taxpayers who did not file taxes are nevertheless required to do so in order to claim a Recovery Rebate Credit.

The 2021 tax season and other details on automatic payments

It is possible for taxpayers to find out how much they earned in Economic Impact Payments by going to their IRS Online Account. From there, they may figure out how much Recovery Rebate Credit they are due. View 2021 Recovery Rebate Credit — Topic A: General Information and FAQ G2: Finding the Third Economic Impact Payment Amount to Calculate the 2021 Recovery Rebate Credit.

2025 Social Security COLA Sparks Concerns Over Financial Stability Among Beneficiaries

When applying for federal benefits like SSI, SNAP, TANF, and WIC, any Recovery Rebate Credit earned will not be considered income.

Helping taxpayers understand and claim all relevant credits and deductions, including Coronavirus tax relief, is a priority for the Internal Revenue Service (IRS) as the 2025 tax filing season approaches.

The fact that many people either don’t know about or are unable to take advantage of tax credits and deductions is a major problem.

The Earned Income Tax Credit and the other credits will be brought to taxpayers’ attention by the Internal Revenue Service (IRS) during the 2025 filing season.