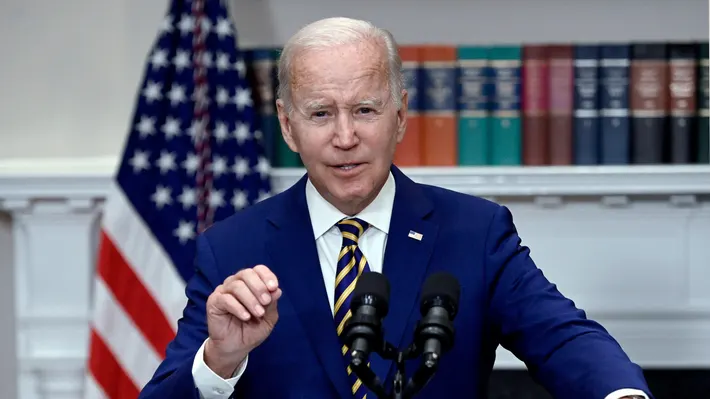

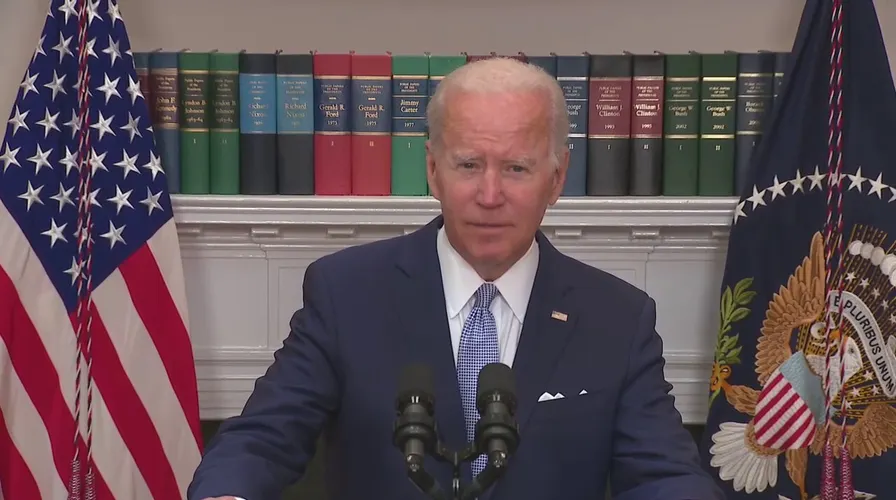

In a groundbreaking move, the Biden Administration has unveiled a new round of student loan forgiveness, providing much-needed financial relief to thousands of borrowers. This comprehensive plan involves the cancellation of a staggering $1.2 billion in student debt, benefiting approximately 153,000 individuals across the nation.

The focus is particularly on those enrolled in the administration’s Saving on a Valuable Education repayment plan.

This initiative comes with specific eligibility criteria. To qualify for the student loan forgiveness program, individuals must be enrolled in the Saving on a Valuable Education repayment plan. Additionally, they should have a proven track record of at least 10 years of consistent payments and must have originally borrowed $12,000 or less for their college education.

Notably, financial advisor Darren James weighed in on the announcement, providing insights for those who may not meet the forgiveness program’s criteria. James emphasizes the significance of being able to afford one’s lifestyle, describing it as the American dream.

He suggests alternative options, such as considering a graduated or extended payment plan to temporarily lower monthly payments until income improves. James also highlights the option to consolidate federal student loan debt and explore income-driven repayment programs.

Addressing the logistics of the debt cancellation process, the article assures borrowers that the relief is expected to happen automatically. Eligible individuals will receive notifications via email, streamlining communication and ensuring prompt awareness of the debt relief.

Related News:

- A 91-Year-Old Dynamo Taking on Trump in a Battle for Justice at the US Supreme Court

- Polarizing Politics: Texas in the Spotlight

- Loeffler Asserts: Affair with Willis Undermines Fairness of Trump Trial in Georgia

For those who may not qualify for the $1.2 billion debt cancellation, the article explores various relief strategies. James recommends exploring income-driven repayment programs, particularly for those experiencing changes in income. Refinancing with a private lender is presented as another option, accompanied by a cautionary note to be mindful of current interest rates.