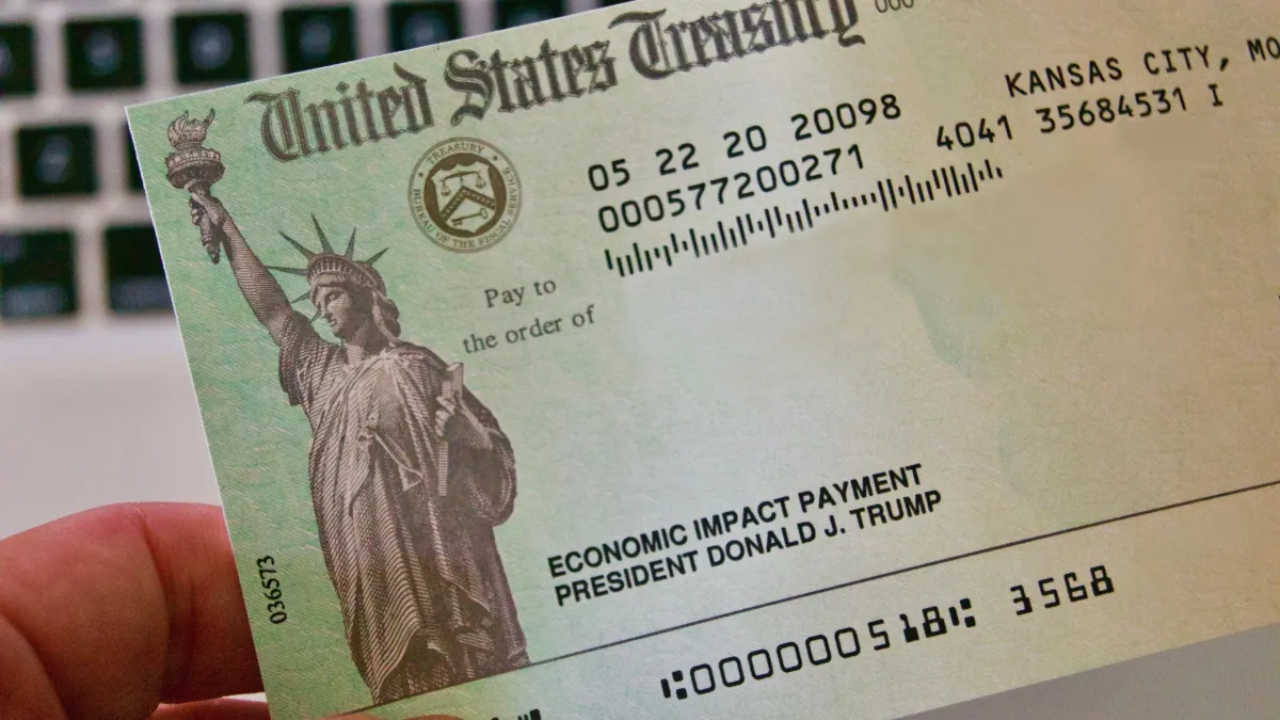

Race Day Live Filing taxes can be tricky, especially when special government programs like stimulus checks are introduced. During the COVID-19 pandemic, the U.S. government approved three rounds of Economic Impact Payments (EIPs), commonly called stimulus checks.

While most Americans received their payments automatically, not everyone did. Some people missed out simply because they hadn’t filed a tax return or were new taxpayers.

Now, there’s good news! The IRS is stepping in to help those who missed out by automatically sending payments to eligible individuals.

Why Some Americans Missed Their Stimulus Checks?

Stimulus checks were essentially advance tax credits sent to eligible taxpayers based on their 2019 or 2020 tax returns. However, the IRS didn’t have data for everyone eligible, especially those who hadn’t filed a tax return.

For those who missed out initially, the IRS allowed them to claim the funds through the Recovery Rebate Credit on their 2021 tax return. However, not everyone did this, leaving some without their stimulus payments.

Automatic Payments for Eligible Taxpayers

In December, the IRS announced a major update. After reviewing its records, the agency identified one million taxpayers who hadn’t claimed their third-round stimulus payment.

Collectively, these taxpayers are owed around $2.4 billion, with each eligible individual receiving up to $1,400.

The best part? There’s no extra work required. According to IRS Commissioner Danny Werfel, the agency is making these payments automatic.

“We’re making these payments automatic, meaning these people will not be required to go through the extensive process of filing an amended return to receive it,” Werfel stated.

If you filed a 2021 tax return and missed claiming the stimulus payment, you can expect your payment by the end of January if you use direct deposit. Paper checks might take a little longer to arrive.

What If You Haven’t Filed Your 2021 Tax Return?

If you haven’t filed a 2021 tax return but think you’re eligible for the $1,400 payment, there’s still time to act. The deadline to file a 2021 tax return and claim the Recovery Rebate Credit is April 15, 2025.

The amount you receive depends on several factors, but the maximum payment is $1,400 per individual. Filing your 2021 tax return may also open the door to other tax credits, like the expanded Child Tax Credit if you had a child under 17 in 2021.

How to Check If You’re Getting a $1,400 Payment?

Wondering if you’re one of the lucky recipients of this automatic payment? Start by reviewing your 2021 tax return. If you didn’t claim the Recovery Rebate Credit, you’re likely on the list.

The IRS also recommends keeping tax records for at least three years from the filing date or two years from the date you paid taxes, whichever is later. These records can help verify if you’re owed a payment.

You can also check your tax records online through your ID.me account. If you don’t have one, setting it up is a smart move.

Not only can you access your tax information, but you can also use it for other government services like Social Security. Plus, it adds an extra layer of protection to your digital identity.

What Else Can You Claim?

In addition to the $1,400 payment, filing a 2021 tax return could help you claim other tax credits.

For instance, the expanded Child Tax Credit provided significant benefits to families with children under 17. By filing your taxes, you ensure that you’re not leaving any money on the table.

Take Action Before It’s Too Late

The IRS is making efforts to ensure that eligible Americans get their stimulus checks, but don’t wait too long. Whether you’re receiving an automatic payment or need to file a 2021 tax return, it’s essential to act now.

With deadlines in place and potential benefits like additional tax credits, taking the right steps can ensure you get the financial support you deserve.

Disclaimer- Our team has thoroughly fact-checked this article to ensure its accuracy and maintain its credibility. We are committed to providing honest and reliable content for our readers.