Senators Gary Peters and Debbie Stabenow are calling on the Social Security Administration (SSA) to address overpayment errors causing financial distress for millions of beneficiaries.

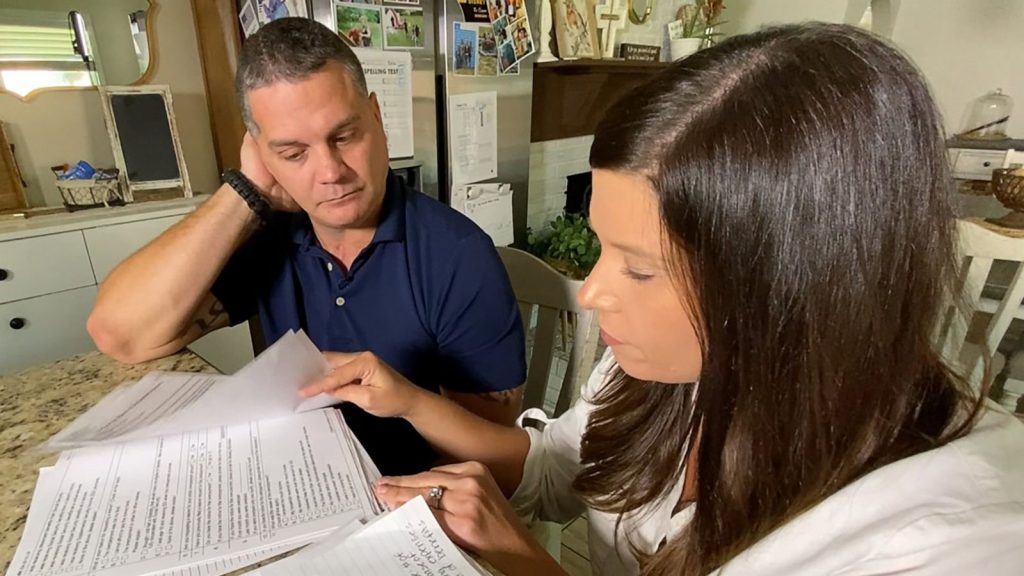

In a letter, they highlighted the significant hardships faced by vulnerable recipients, including seniors and the disabled, who are unexpectedly overpaid by the SSA.

The senators emphasized that overpayment errors, totalling a record $11 billion in 2022, can take years to detect, leaving recipients burdened with massive debts. Recipients are required to repay the funds, even if they are not at fault.

The senators urged the SSA to improve processes and controls to minimize overpayments and protect critical benefits.

Overpayment errors can occur due to miscalculations or failure to report income changes. Recipients, who notice discrepancies, are encouraged to report them immediately. The senators revealed that two million people are overcompensated annually, raising concerns about the SSA’s payment accuracy.

Related Articles:

- Urgent Call for Social Security Fix as Seniors Face Shocking Bills

- Say Goodbye to These 5 Bills Forever When You Become Debt-Free!

- Trump Approved for NY Primary Ballot Amidst Controversy

Recipients facing overpayment notices have options, including appealing the bill, setting up repayment plans, or seeking a waiver from the SSA. The agency handles overpayments on a case-by-case basis, offering flexibility to those affected.

In conclusion, the senators’ call for SSA reforms reflects a commitment to alleviate financial burdens on beneficiaries. The rise in overpayment errors underscores the urgency of addressing systemic issues to ensure the effective functioning of vital government programs and protect vulnerable populations.