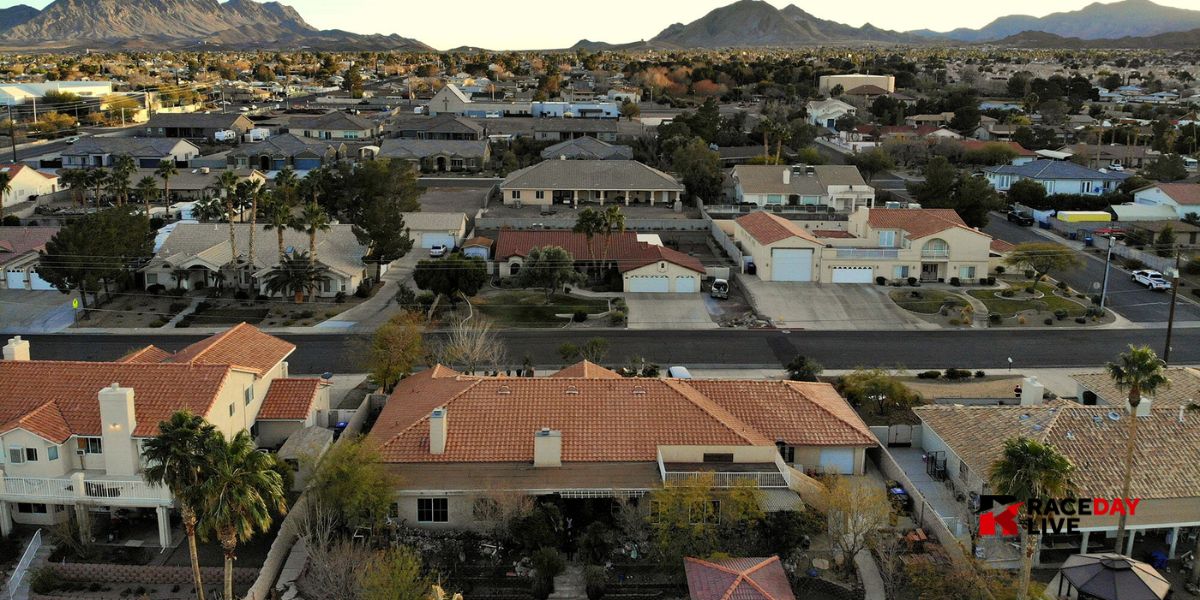

Race Day Live (Las Vegas, NV) – According to Freddie Mac, the average interest rate on a long-term mortgage has climbed for the fourth week in a row that has just occurred.

The standard 30-year fixed-rate loan increased to 6.93%, which is an increase from the previous week’s rate of 6.91%. When compared to the previous year, the average rate was 6.66 percent, which was the highest level since July.

Contrary to popular belief, the increase in mortgage rates can be ascribed to a better economy. This is because mortgage rates are tied to 10-year Treasury bills rather than the primary interest rate that is set by the Federal Reserve.

When asked about the effect that these increased interest rates have had on the home market, a local loan officer made the following statement: “There’s definitely more people in the market. I think they have just accepted, hey, rates are higher. We don’t know if they’re going to higher. Home prices haven’t gone down – in some areas they have – but as a whole they’ve stayed pretty steady. So, I think people are just biting the bullet. It’s probably not any better.”

A significant number of people working in the housing industry are of the opinion that inhabitants of Southern California whose homes were burned by wildfires should think about moving to the Las Vegas territory. It is possible that this potential influx may put even more pressure on the local housing market, which is already struggling with a lack of available inventory.

Read More – Eligible California Families Can Claim $725 in January 2025 Stimulus Relief