Race Day Live Social Security is one of the most important programs for American seniors, providing a steady income to those who’ve worked for many years.

In fact, a National Institute on Retirement Security survey shows that 87% of Americans believe it should be a top priority despite the country’s fiscal challenges.

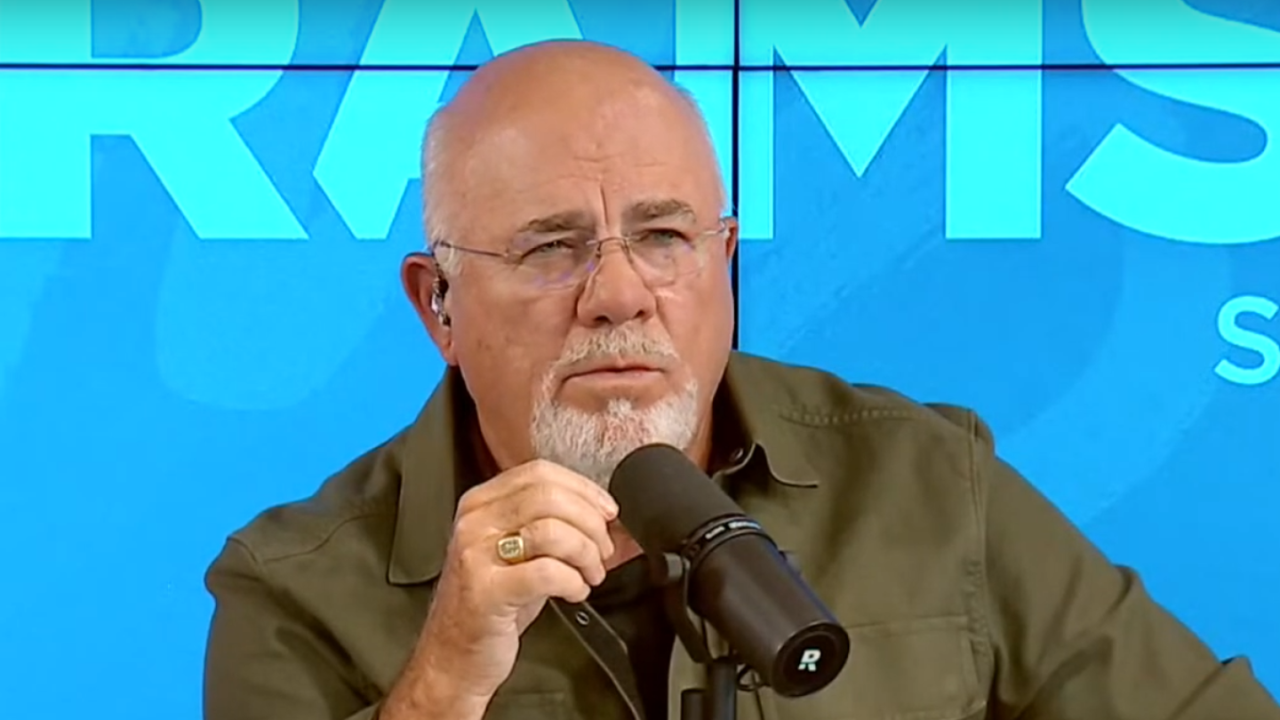

However, not everyone agrees with how it works. Financial expert Dave Ramsey has been a vocal critic of Social Security.

Back in 2019, he called it a “broken, screwed up, mathematical disaster” and even claimed that he’d been “robbed” by contributing to the system.

Despite his negative view on Social Security, Ramsey does believe that seniors should begin taking their benefits at a specific age to make the most of the program. Here’s why.

When is the right time to start taking benefits?

You can begin taking Social Security benefits as early as age 62, but the full benefits don’t kick in until you reach your full retirement age.

This has led to a lot of debate among financial experts about the best age to begin collecting these benefits. While some recommend waiting until 70 to maximize the payout, Ramsey believes it’s smarter to start taking the benefits as soon as you’re eligible.

So, Why Does Ramsey Recommend This?

First, He Argues that The only Way to Know when Is the Best Time to Start Taking Social Security Is if You Know when You’ll Pass Away.

If You Expect to Live Into Your 80s or Beyond, Waiting until 70 Might Make Sense to Maximize Your Benefits. but If You Don’t Make It to 70, You’ve Lost out On Years of Your Contributions. So, Ramsey Thinks It’s Better to Take Benefits Early Rather than Risk Not Seeing the Full Payout.

Second, Ramsey Points out That Social Security’s Fund Is Mismanaged.

The Congressional Budget Office (cbo) Predicts that The Trust Fund for Social Security Will Run out By 2033. After That, Benefits Could Be Cut by As Much as 25% Unless the Government Steps in To Address the Shortfall.

Lastly, Ramsey Believes that Taking Social Security Early and Investing the Funds in An Index Fund Can Be More Profitable than Waiting.

He Argues that You Can Earn a Better Return on Investment than The Social Security System Will Provide if You Delay Your Benefits. “you Can Get a Better Rate of Return than They Will Pay You by Waiting,” Ramsey Said on His Show.

The Risk of Investing Early

While Ramsey’s Advice Sounds Good, It’s Important to Consider the Risks Involved. Social Security Benefits Increase the Longer You Wait to Take Them, Especially if You Wait until You’re 70.

This Guarantees a Higher Monthly Benefit, Which Can Be Crucial for Retirees.

However, Ramsey’s Strategy Relies on The Stock Market, Which Is Inherently Unpredictable. if The Market Performs Poorly During the Time You’re Investing, You Could End up With Less Money than If You Had Just Taken the Benefits at A Later Age.

For Younger Investors, the Risk of Market Downturns May Not Be as Significant, but For Someone in Their 60s, It Could Mean the Difference Between a Secure Retirement and A Financial Setback.

In Contrast, the Social Security Fund Is Backed by U.S. Treasury Bonds, Which Offer More Stability and Lower Risk.

while These Bonds Don’t Provide Huge Returns, They Are a Safer Investment than The Stock Market, Especially for People Who Are Nearing Retirement Age.

Read More:

- Major Problem With Social Security: Suze Orman’s Warning to All Americans!

- Missed Your January Social Security Payment? Find Out When You’ll Get Paid?

Will Social Security Go Bankrupt?

Ramsey Also Worries About the Insolvency of Social Security, but There Are Several Ways that The Program Can Avoid This Fate. Congress Has the Power to Raise Taxes or Increase the Retirement Age to Ensure the Fund Stays Solvent.

in Fact, Similar Reforms Were Made in The 1980s when Social Security Was Nearly Bankrupt, and Experts Predict that A Similar Deal Will Likely Be Made Again Before the Fund Runs out In 2033.

Conclusion

The Right Time to Start Social Security Benefits Ultimately Depends on Your Personal Situation, Including Your Life Expectancy, Investment Preferences, and Ability to Handle Risk.

While Ramsey Recommends Taking Benefits Early and Investing Them, Others May Prefer to Wait and Let the System Do the Work for Them.

Whatever You Decide, It’s Important to Plan Carefully and Consider Both the Risks and Rewards of Your Choices.

Disclaimer- Our team has thoroughly fact-checked this article to ensure its accuracy and maintain its credibility. We are committed to providing honest and reliable content for our readers.

+ There are no comments

Add yours