Race Day Live Americans who missed out on stimulus checks during the pandemic may soon receive their payments.

The Internal Revenue Service (IRS) is sending out payments of up to $1,400, but the deadline to qualify is coming up fast.

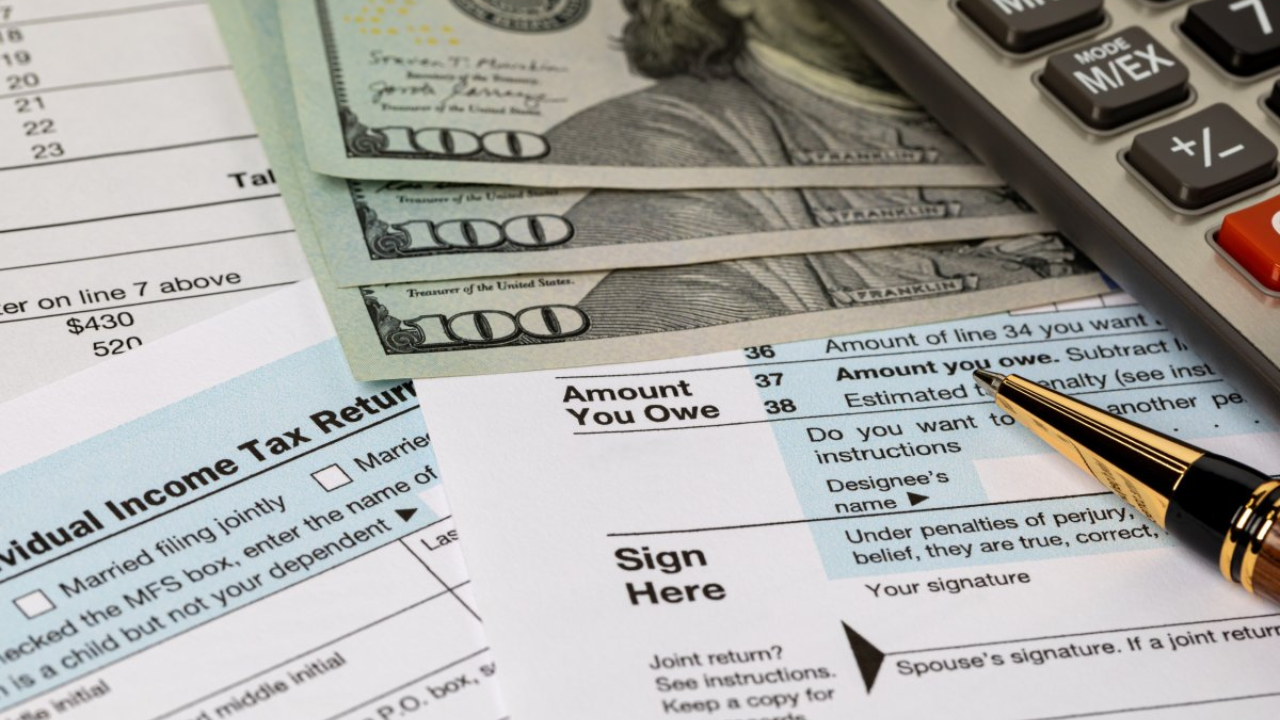

The IRS announced that taxpayers who did not claim the Recovery Rebate Credit when filing their 2021 tax return may receive a check.

These payments are being sent automatically, with most people expected to get them by late January 2025.

Who Is Eligible?

The IRS said that around one million taxpayers who filed their 2021 tax returns did not claim the Recovery Rebate Credit. If you are one of them, you could be getting a payment soon.

To check if you qualify, look at your 2021 tax return. If the Recovery Rebate Credit field is blank or marked as $0, you likely did not claim the credit and might be eligible for the new payment.

The total amount being sent out is estimated to be around $2.4 billion.

Background on Stimulus Payments

During the COVID-19 pandemic, the IRS issued three rounds of stimulus checks: two in 2020 and one in 2021. These payments totaled around $814 billion, according to the Pandemic Response Accountability Committee, a government oversight group.

The amount of money each person gets depends on different factors, but the highest possible payment is $1,400 per individual.

Payments will be directly deposited into bank accounts or sent as paper checks. If you qualify, you will also receive a letter from the IRS notifying you about your payment.

IRS Statement on Payments

In December, IRS Commissioner Danny Werfel explained why these payments are happening:

“The IRS continues to work hard to make improvements and help taxpayers. These payments show our commitment to supporting taxpayers who missed out on their stimulus checks.”

He added, “Looking at our internal data, we realized that one million taxpayers overlooked claiming this complex credit when they were eligible.

To make things easier, we are sending the payments automatically so they don’t have to go through the process of filing an amended return.”

Read More:

- Deadline Approaching: IRS Urges Americans to Claim $1,400 Stimulus!

- 5 Smart Ways to Create Your Own ‘Stimulus Check’ in 2025 and Boost Your Income!

What You Should Do Now?

If you filed your 2021 tax return but did not claim the Recovery Rebate Credit, there’s nothing you need to do—the IRS will send your payment automatically.

However, if you have not yet filed your 2021 return, you may still be eligible. The IRS is encouraging taxpayers to submit their 2021 returns before the April 15, 2025, deadline to avoid missing out on the credit.

If you believe you qualify but do not receive a payment by February, check with the IRS or review your 2021 tax return to confirm your eligibility.

This is likely the final chance for Americans to claim any missing stimulus money, so make sure to take action before the deadline!

Disclaimer- Our team has thoroughly fact-checked this article to ensure its accuracy and maintain its credibility. We are committed to providing honest and reliable content for our readers.

+ There are no comments

Add yours