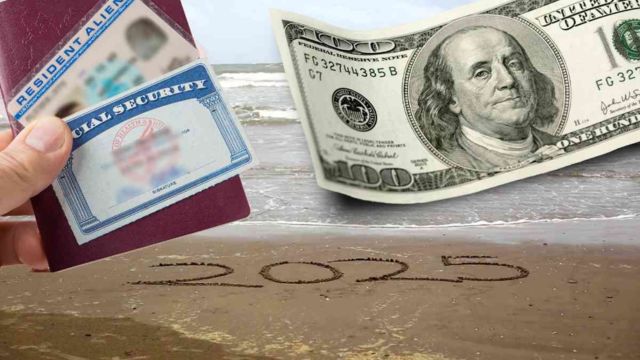

If all of the qualifications are met, some retirees will get a Social Security benefit of $4,873. Others may qualify but with an average payment of $1,919. The amount you can get from the Social Security Administration is determined by your employment history and filing record.

Regardless of the payment amount, a Social Security direct deposit or check will be sent on September 11. Indeed, this is the first of three rounds. Those who are getting retirement benefits but have not yet received money should check their eligibility in the coming weeks.

Eligibility: Social Security on 9/11

To get money on September 11, you must have received retirement benefits after April 30, 1997. Furthermore, you must have been born between the 1st and the 10th.

Those who are in a similar circumstance but were born between the 11th and the 20th will receive their money on September 18, 2024. The last payment date of September 25 will only apply to retirees born after the 20th.

That’s from the 21st to the 31st. The greatest amount for which they may qualify is $4,873, while the typical payment may be more frequent. Those who received payments before May 1997 will receive Social Security on October 3. If you get retirement benefits and SSI, your next payment will be on October 3, 2024.

$4,873 from Social Security on September 11

The catch is that you must have worked for 35 years in jobs covered by the Social Security Administration, earning the taxable maximum during that time, and then filed at age 70. Check the checklist to determine if you meet all of the required conditions to receive $4,873 in 2024.

To file for Social Security, you must be at least 70 years old, have worked for 35 years, have paid enough Social Security taxes, have earned the taxable limit for 35 years, and have not violated any SSA rules.

Filing before the age of 70 is acceptable, but it lowers your payment amount. For example, filing at age 62 often results in a 30% reduction. The maximum payout at age 62 is $2,710, whereas it is $3,822 at full retirement age.

+ There are no comments

Add yours