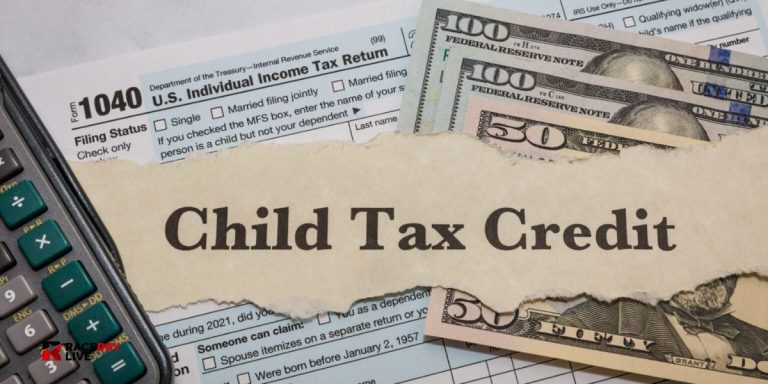

Race Day Live (Los Angeles, CA) – Entry-level California home expenses are up 88% from 2020, with fires expected to drive up prices even further.

According to a new research from the nonpartisan, state-funded Legislative Analyst’s Office, the monthly payment to buy an entry-level California home has increased by 88% since 2020. With the continuing wildfires destroying over 10,000 properties in high-income neighborhoods, prices are expected to rise even further as wealthy families seek new homes.

The LAO also observes that home prices fell momentarily early in the epidemic in 2020; growing prices, fueled by low interest rates, cause home payments to climb even as rates remained stable, with rate hikes beginning in 2022 making financing those higher purchase prices even more costlier.

According to the LAO, the quick increase in mortgage rates from 3% before 2022 to 7% now means that many homeowners cannot afford to relocate, even if they wanted to, placing additional pressure on house prices as fewer homeowners elect to sell.

“For example, if a homeowner with a mortgage rate of 5 percent sold their home and bought a new similarly-priced home at current interest rates, they would have monthly payments approximately 18 percent higher. For the typical homeowners, this amounts to over $300,000 more in payments over the life of a 30-year loan. As a result, many are choosing to stay put, significantly limiting the number of homes available for sale in the state’s tight housing market,” the LAO wrote.

“81 percent of California homeowners currently have mortgage rates below 5 percent, while new buyers face the much higher 7 percent rate,” the LAO wrote. “If a homeowner with a mortgage rate of 5 percent sold their home and bought a new similarly-priced home at current interest rates, they would have monthly payments approximately 18 percent higher. For the typical homeowners, this amounts to over $300,000 more in payments over the life of a 30-year loan.”

Read More – Southern California Wildfire Survivors May Drive Demand in Las Vegas Housing Market

“As a result, many are choosing to stay put, significantly limiting the number of homes available for sale in the state’s tight housing market,” continued the LAO.

With over 12,000 buildings destroyed by the ongoing fires, most of which are concentrated in wealthier areas such as the Pacific Palisades, where the median home for sale prior to the fire cost $4.6 million, prices are already rising as high-income families try to find temporary housing while their homes are rebuilt or relocate entirely.

The City of Los Angeles approved just 8,706 new residences in 2024, down from 11,311 in 2023 and 15,295 in 2022, implying that the wildfires may reduce the city’s overall housing supply as construction slows.

Trending – Eligible California Families Can Claim $725 in January 2025 Stimulus Relief

According to Hilgard Analytics’ 2024 analysis on residential permitting in Los Angeles, the current fall can be attributed to high borrowing rates and the city’s new transfer tax on all property valued at over $5 million.

+ There are no comments

Add yours