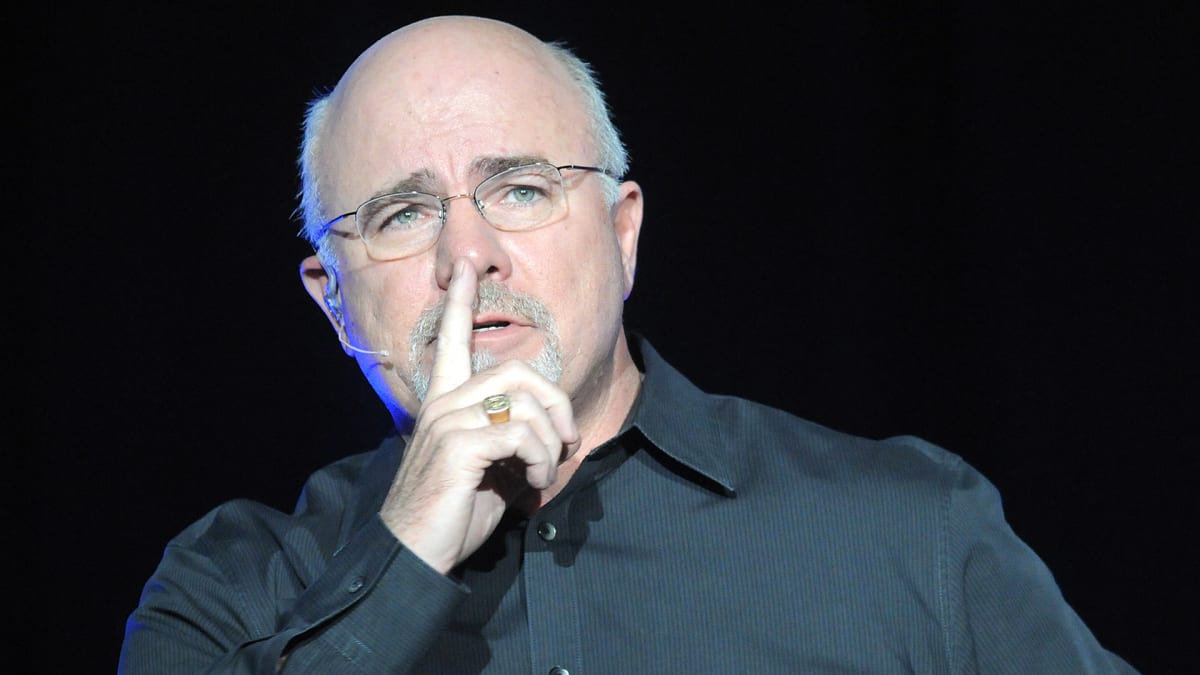

Many U.S. workers rely on employer-sponsored 401(k) plans and Social Security as their primary sources of retirement income. However, personal finance expert and radio host Dave Ramsey warns that these alone may not be enough for a comfortable retirement.

The Limitations of Social Security

Social Security was never designed to fully support retirees. The average monthly Social Security check is around $1,900, totaling $22,800 annually. This figure barely exceeds the 2025 poverty line of $21,150 for a two-person household. Depending solely on Social Security leaves retirees financially vulnerable.

Why a 401(k) Isn’t Enough

Contributing to a 401(k) is a smart move, especially if an employer offers a match. Contributions are made pre-tax, allowing investments to grow tax-deferred. However, Ramsey emphasizes that a 401(k) should only be the starting point of a retirement strategy, not the sole source of savings.

The Importance of a Roth IRA

Ramsey advises workers to also invest in a Roth IRA, which offers significant tax advantages. Unlike a 401(k), contributions to a Roth IRA are made with after-tax dollars, but the money grows tax-free and remains tax-free upon withdrawal in retirement.

Additionally, Roth IRAs provide a wider range of investment choices, including thousands of mutual funds. This flexibility allows investors to diversify their portfolios and optimize returns.

Balancing Investments for a Stronger Retirement Plan

Ramsey recommends using both a 401(k) and a Roth IRA in tandem to maximize growth and security. A well-balanced investment strategy can leverage the benefits of both tax-deferred and tax-free accounts, reducing risk while capitalizing on market growth.

By diversifying retirement investments beyond just a 401(k) and Social Security, workers can better prepare for long-term financial security and ensure a more comfortable retirement.

Disclaimer – Our editorial team has thoroughly fact-checked this article to ensure its accuracy and eliminate any potential misinformation. We are dedicated to upholding the highest standards of integrity in our content.

+ There are no comments

Add yours