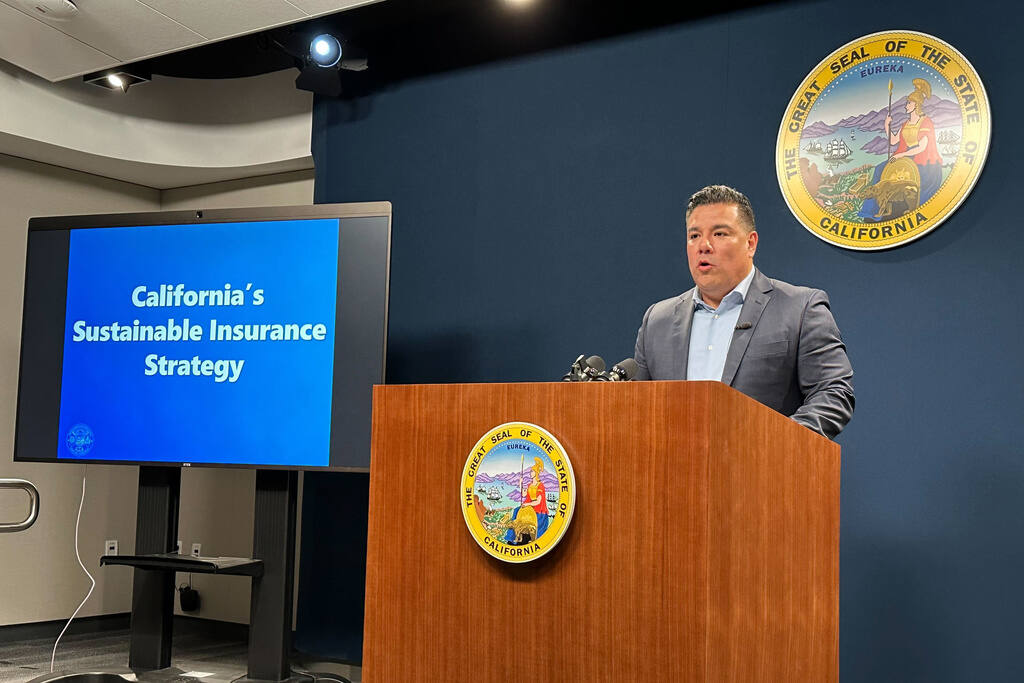

In response to State Farm’s decision to not renew over 70,000 insurance policies in California, the state’s insurance commissioner, Ricardo Lara, has voiced concerns about the situation.

Commissioner Lara stated, “This is a real crisis,” highlighting the significance of the issue during an interview with Eyewitness News.

State Farm, California’s largest home insurance company, announced its decision to not renew 72,000 policies in the state starting this summer. This move has raised concerns about higher insurance premiums and policy non-renewals among residents.

Lara emphasized the complexity of the situation, acknowledging the delicate balance required to regulate insurance companies while ensuring they remain in California.

He pointed out that insurance companies are not obligated to operate in the state and highlighted past instances where overregulation led to adverse outcomes, such as the cessation of earthquake insurance after the Northridge earthquake.

Consumer Watchdog, an organization critical of Lara’s handling of insurance issues, expressed dissatisfaction with the commissioner’s approach. They called for new laws to mandate insurance companies to provide coverage to all eligible individuals and protect their homes.

The non-renewal of insurance policies is not unique to State Farm, as Allstate also ceased issuing new homeowners insurance policies to customers in California in 2022.

Lara outlined his plan to address the situation, which includes revising the risk assessment models used by insurance companies to ensure fairer rates for homeowners. He emphasized the need for transparency in these models to better assess risk and lower insurance costs for consumers.

Related Articles:

- New York Rep Hakeem Jeffries, 53, Points Finger at Republicans’ ‘Performative Politics’

- Polarizing Politics: Texas in the Spotlight

- Understanding Landslides: Risks and Precautions

Additionally, Lara assured affected policyholders that the California Department of Insurance would assist them in transitioning to new insurance providers. The department aims to connect individuals with companies that are still writing policies in California to ensure continued coverage.

Overall, Lara emphasized the importance of addressing the challenges posed by insurance non-renewals and implementing measures to protect consumers while maintaining a competitive insurance market in California.