In a significant move, Georgia’s top Republican lawmakers unveiled their legislative agenda for 2024, focusing on initiatives aimed at providing tax relief to residents grappling with the financial strains induced by high inflation and escalating home costs. House Speaker Jon Burns, flanked by several Republican colleagues, gathered at the Capitol to discuss the proposed legislation, emphasizing the party’s commitment to easing the burden on Georgians.

At the heart of their plans is the intention to lower both income and property taxes, coupled with measures to extend tax relief to parents. Speaker Burns highlighted Georgia’s conservative fiscal approach as the foundation for pursuing avenues to continually reduce taxes, asserting that the state’s prudent financial management allows for such initiatives despite economic challenges.

A key proposal within the legislative plans is Governor Brian Kemp’s priority to decrease the flat income tax rate from 5.49% to 5.39%. This reduction, if approved, would result in a substantial $1 billion cut in tax collections for the state in the upcoming fiscal year. Furthermore, the introduction of an additional $1,000 child tax deduction is anticipated to provide tangible relief to families, potentially saving around $54 for each child based on the current income tax rate.

House Speaker Burns emphasized the commitment to returning more money to Georgia taxpayers, stating, “We’re doubling down on delivering economic relief to families across our entire state by lowering taxes for parents, homeowners, small business owners, and all families in Georgia.”

Read more:

- California Lawmaker Proposes Speed Limit Technology to Curb Road Deaths

- Tragedy Strikes as Young Dancer Dies from Mislabeling of Peanuts in Cookies

- New Concealed Carry Law Denied by Another Northern California Count

- U.S. Takes Action to Safeguard Whales Around Offshore Wind Farms

In a bid to alleviate property tax burdens, Burns supports a House bill that seeks to double the state’s homestead tax exemption for homeowners, potentially resulting in a $100 million reduction in property tax bills statewide. Representative Matt Reeves, a Duluth Republican, intends to sponsor a bill updating the longstanding $2,000 state homestead exemption to reflect current economic realities. The proposed increase to $4,000 aims to provide homeowners with more substantial relief amid rising home values.

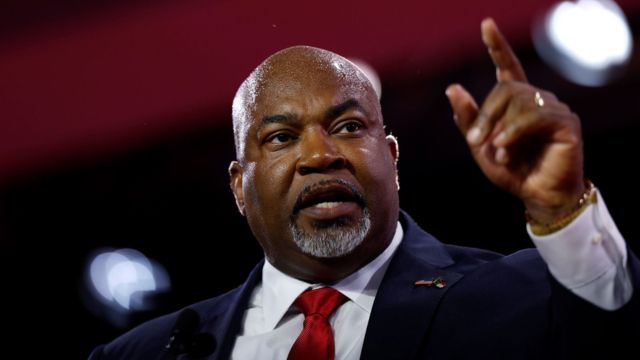

On the Senate front, Lt. Gov. Burt Jones, a Butts County Republican, is championing a measure that could limit increases in property taxes. A scheduled Senate panel hearing on Monday will delve into legislation proposing a 3% cap on the year-over-year rise in the amount used to calculate property taxes based on home valuations.

However, not everyone is convinced that these tax relief measures will have a significant impact on the everyday lives of Georgians. The Georgia Budget and Policy Institute (GBPI) argues that while reductions in income and child care taxes may provide some relief, the actual dollar savings might not be substantial for individuals. GBPI urges state officials to consider utilizing the record $16 billion budget surplus for substantial investments in public needs such as education, healthcare, and infrastructure.

Danny Kanso, Senior Fiscal Analyst at GBPI, highlighted the potential limited impact of tax reductions on middle-income households. He emphasized that the estimated savings of $34 per year for such households might not be sufficient to address broader concerns. Kanso underscored the importance of redirecting surplus funds towards critical areas like healthcare and education, suggesting that these investments could have a more meaningful impact on Georgia families.

As Georgia Republicans press forward with their ambitious tax relief plans, the debate over the most effective use of the state’s budget surplus intensifies. The juxtaposition of reducing taxes against making substantial investments in public needs reflects the complex balancing act faced by lawmakers in addressing the multifaceted challenges confronting Georgia residents. The coming legislative sessions will undoubtedly provide a platform for a robust discourse on the most prudent path forward for Georgia’s economic well-being.

+ There are no comments

Add yours