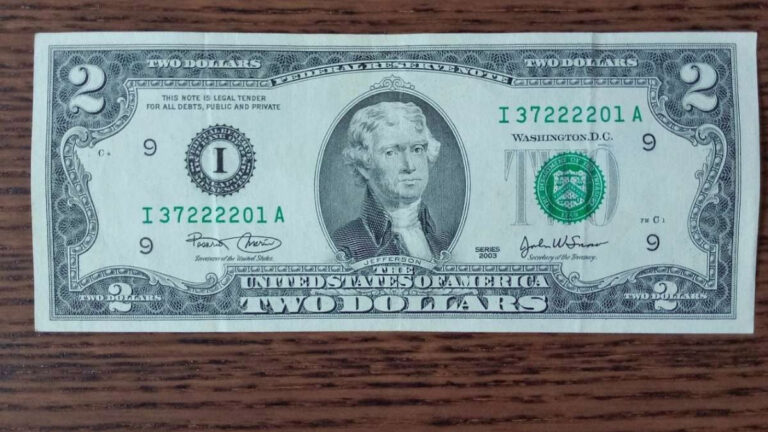

Starting February 11th, businesses in New York State face a shift in how they can charge customers opting to pay with a credit card. A recent bill, Assembly Bill 2672, signed into law, ushers in new guidelines aimed at enhancing transparency in credit card transactions. The legislation mandates businesses to provide a clear breakdown of fees associated with credit card payments, ensuring customers are well-informed about potential surcharges. Let’s delve into the key aspects of these changes and their implications for both businesses and consumers.

Credit Card Transparency Legislation: What You Need to Know

The focal point of the new legislation is transparency. Businesses are now obligated to disclose the highest possible price consumers might pay when opting for credit card transactions. This information aims to empower customers to make informed choices, understanding the potential additional costs associated with credit card payments. Simultaneously, businesses must display the alternative price offered for other payment methods, such as cash, check, or debit card.

Navigating Credit Card Fees in New York: Unveiling the Changes

Many businesses encounter additional fees from credit card companies when customers use their cards for transactions. In some instances, these fees are passed on to customers who choose the convenience of card payments. The new guidelines establish clear parameters for businesses, ensuring that any permissible surcharge aligns with or is less than the amount charged to the business by credit card providers.

Read more:

- Record Rainfall and Dangerous Winds: Millions in California at Risk

- Los Angeles Smog Worsens, EPA Considers Rejecting Pollution Control Plan

- Trans Drivers Unable to Change Gender on Licenses in Florida

- Northern Lights Treat for New Mexico Residents!

Detailed Regulations Effective February 11th

As of the specified date, businesses must adhere to the following regulations when processing credit card transactions:

- Transparent Display of Prices: Gone are the days of generic signs notifying customers of credit card surcharges. Businesses are now required to prominently display both the credit card and cash prices. This ensures that customers are aware of the potential fees associated with credit card transactions.

- Equal or Lesser Surcharge: Any surcharge imposed by a business must be equal to or less than the amount charged to the business by credit card providers. This regulation aims to prevent excessive surcharges that could unfairly burden consumers.

Consequences for Non-Compliance

The legislation comes armed with consequences for businesses failing to comply with the new guidelines. Any business found charging customers more than the actual amount charged by their credit card provider could face fines of up to $500 for each violation. This enforcement mechanism is designed to incentivize businesses to diligently adhere to the prescribed rules, promoting fair and transparent transactions.

Shifting from Generic Notifications to Detailed Price Displays

A notable change is the requirement for businesses to move away from generic notifications of credit card surcharges. Instead, the emphasis is on providing a comprehensive breakdown of prices. This includes displaying the specific prices for credit card transactions and, notably, the alternative prices for other payment methods. This shift ensures that customers have a clear understanding of the financial implications associated with their preferred payment choices.

Implications for Businesses and Consumers

For businesses, these changes necessitate a reevaluation of their pricing strategies and communication practices. Clear signage and price displays become imperative to comply with the new regulations. Additionally, businesses must ensure that any surcharges align with the fees they incur from credit card providers.

Consumers, on the other hand, stand to benefit from increased transparency. Armed with information about potential surcharges, they can make more informed decisions about their preferred payment methods. The new regulations align with consumer protection principles, fostering a fair and open marketplace.

Conclusion: Navigating a Transparent Credit Card Landscape

As businesses in New York State prepare to implement the new credit card fee guidelines, the overarching theme is transparency. The legislative changes empower consumers with information, encouraging businesses to adopt clear and forthright communication practices. The shift from generic notifications to detailed price displays marks a significant step toward creating a more transparent and equitable credit card landscape. As the effective date approaches, businesses and consumers alike must familiarize themselves with these changes to ensure seamless and compliant transactions.

Governor Hochul’s Controversial Education Plan Sparks Backlash

In a recent State of the State address, New York Governor Kathy Hochul announced a sweeping change to the state’s higher education admission policies, igniting a wave of controversy. The proposal entails granting automatic admission to the State University of New York (SUNY) and the City University of New York (CUNY) to every high school student graduating in the top 10% of their class. While aiming for increased accessibility, the plan has faced significant pushback, particularly for its potential adverse impact on meritocracy.

The Shift in Admission Dynamics

Traditionally, admission to esteemed institutions like SUNY Binghamton has been competitive, considering factors such as academic performance and standardized test scores. However, Governor Hochul’s plan seeks to alter this landscape by guaranteeing admission to the top decile of graduating high school students.

Meritocracy vs. “Source Diversity”

The proposal has sparked a heated debate between proponents of meritocracy and those advocating for “source diversity.” Critics argue that such a system fails to account for the varying rigor and standards across different high schools. The example of a student from the renowned Bronx High School of Science, a bastion of academic excellence, has become a focal point of the discussion.

Flaws in the 10% Scheme

Detractors of the plan highlight several flaws. Firstly, they argue that it discriminates against high-achieving students from more demanding educational institutions. Secondly, the plan is criticized for providing a superficial solution to a more profound issue – the state of education in underperforming schools.

Historical Context and Resonance with Past Biases

Drawing parallels with historical incidents of biased admission policies, particularly in the 1920s when Harvard implemented “geographic diversity” to limit the number of Jewish students, critics suggest a troubling pattern. The plan, they argue, may be perpetuating discriminatory practices, now subtly directed towards Asian Americans.

Dog-Whistle Terms and Controversial Motivations

Critics of the plan are quick to point out what they consider as “dog-whistle terms” such as “equity,” “underrepresented,” and “marginalized.” These terms, they contend, echo arguments used in the defense of controversial admission practices in institutions like Harvard and specialized high schools in New York City.

Real Problem vs. Distraction

While Governor Hochul’s plan aims to address issues of diversity and equity, opponents argue that it distracts from the root cause of educational disparities. Highlighting a failing school like PS 197, critics argue that the real issue lies in the educational system’s shortcomings, affecting students of all backgrounds, including the 17% who are Asian American.

Unintended Consequences

The 10% scheme, according to its critics, falls short in multiple ways. It is seen as discriminatory against Asian Americans, offering a superficial solution to deeper educational problems, and diverting resources from universities to address issues that should have been tackled at earlier stages of education.

Questioning the Texas Model

In response to those holding up Texas’ 10% admission scheme as a model, critics argue that it does not apply universally, with exceptions for top-ranking campuses. They also question the validity of studies claiming the scheme’s success, pointing to flawed metrics and inflated college grades.

A Call for Retraction

Opponents of Governor Hochul’s plan are urging a reconsideration of the 10% scheme, emphasizing its potential negative consequences. They call for a more nuanced approach that addresses educational disparities at their roots and ensures a fair and meritocratic system for all students.

Conclusion: The Battle Over Admission Policies

As New York grapples with the proposed changes to higher education admission, the debate intensifies. The clash between the principles of meritocracy and the pursuit of diversity underscores the complexity of crafting admission policies that are both inclusive and fair. As stakeholders on both sides present their arguments, the future of Governor Hochul’s 10% scheme remains uncertain, hanging in the balance of public opinion and potential legislative scrutiny.

+ There are no comments

Add yours