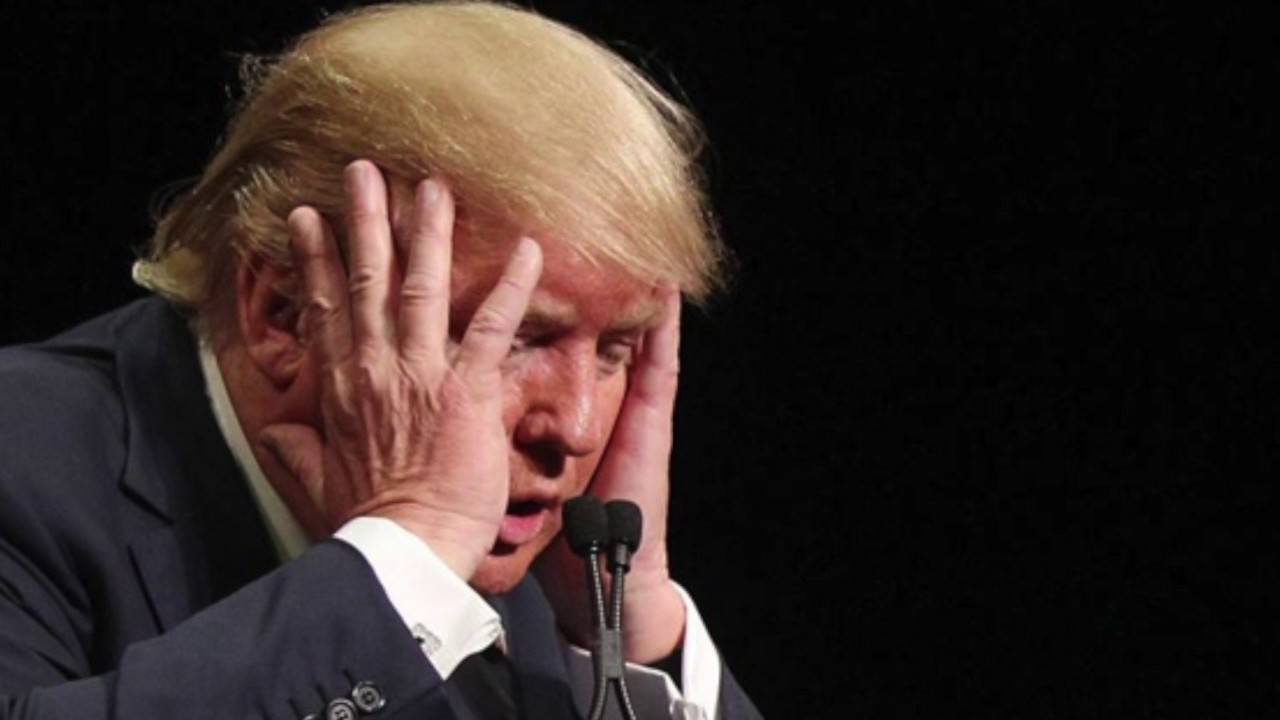

The legal woes of former U.S. President Donald Trump took a dramatic turn over the weekend as a court-appointed special monitor, overseeing the fraud case against him in New York, raised questions about a purported $48 million loan. The loan, which Trump has claimed for years, appears to be non-existent, leading to renewed scrutiny and allegations of potential tax evasion.

The revelations came to light through a letter submitted by former federal judge Barbara Jones to Manhattan Supreme Court Justice Arthur Engoron. Jones, tasked with reviewing Trump’s business dealings through the Trump Organization as part of New York Attorney General Letitia James’ business fraud case, disclosed her findings on the contested loan. The letter, which is likely to influence Engoron’s upcoming verdict, disclosed that there were no loan agreements documenting the $48 million loan’s existence.

Jones indicated that inquiries into the loan revealed no formal documentation, and the Trump Organization itself conceded that the loan never existed. Consequently, the loan would be expunged from corporate financial statements and forms submitted to the Office of Government Ethics.

This revelation casts a shadow over previous financial disclosures by Trump, including forms submitted as recently as October, indicating indebtedness to Chicago Unit Acquisition. Business Insider suggests that these disclosures might have intentionally included inaccuracies about the debt, potentially equating to tens of millions of dollars.

Read more:

- California Lawmaker Proposes Speed Limit Technology to Curb Road Deaths

- Tragedy Strikes as Young Dancer Dies from Mislabeling of Peanuts in Cookies

- New Concealed Carry Law Denied by Another Northern California Count

- U.S. Takes Action to Safeguard Whales Around Offshore Wind Farms

“If Judge Jones’ letter is accurate, that amounts to tax evasion,” remarked Martin Lobel, a tax lawyer, underlining the gravity of the situation.

The origins of the purported loan have been a subject of speculation since 2019 when Mother Jones raised questions about a “mystery loan.” The publication reported that Trump’s debt had been partially forgiven by a hedge fund, prompting suspicions that Trump might have invented the loan and engaged in debt-parking practices.

Debt-parking involves “big-time borrowers” temporarily avoiding taxes on loans by purchasing debt through a corporation. However, if the borrower parks the debt indefinitely without any intention of repayment, it violates federal tax law.

Jones’ recent findings seem to align with Mother Jones’ earlier theories, potentially exposing Trump to allegations of having misled the government about his finances for years. Jordan Libowitz, communications director at Citizens for Responsibility and Ethics in Washington, commented, “It appears that Trump knowingly and intentionally broke the law.”

The letter from the special monitor has broader implications, raising questions about the conduct that the Republican Party aims to shield from IRS penalties. Recently, the GOP secured concessions for a budget deal that included accelerated funding cuts to the IRS, a move that aligns with the party’s stance against penalizing wealthy tax evaders.

As Trump faces the prospect of Engoron’s verdict and the potential legal consequences of the fabricated loan, the controversy adds another layer to the legal challenges surrounding the former president, who is concurrently vying for the GOP’s presidential nomination in the 2024 election. The unfolding developments are poised to shape the trajectory of Trump’s legal battles and political future.

+ There are no comments

Add yours