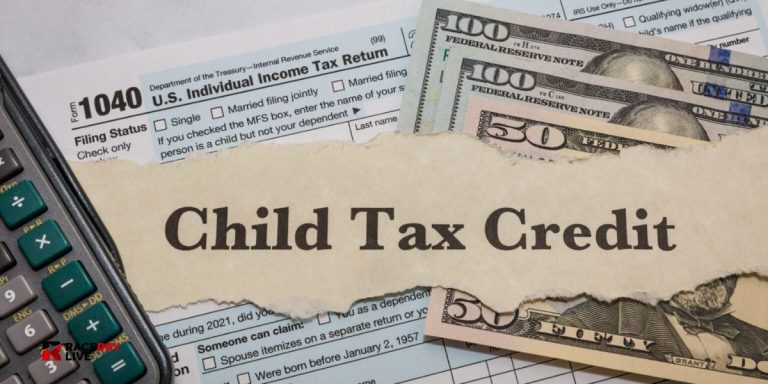

In an effort to revive struggling businesses, Congress members Ro Khanna and Debbie Dingell have introduced the Made in the USA Tax Credit Act. This proposed bill aims to incentivize Americans to shop at small U.S. businesses by offering financial rewards.

Under the bill, individuals could receive up to $2,500 in tax credits, while couples stand to gain $5,000. To qualify, purchases must adhere to the Federal Trade Commission’s Made in the USA standards, ensuring the product is predominantly manufactured in the U.S.

The bill focuses on supporting small businesses with fewer than 500 employees, excluding luxury items, tobacco, firearms, and vehicles. Eligibility criteria include an individual earning less than $125,000 annually and couples making under $250,000.

Representative Dingell emphasized the importance of investing in American manufacturing for innovation and progress. Representative Khanna highlighted the bill’s role in making items more affordable for consumers while supporting American businesses and workers.

Although the proposal is currently in the House Committee on Ways and Means, it faces a lengthy process, needing approval from the House, Senate, and President Biden to become law.

Related Articles:

- First Amendment Battle: Students Challenge Drag Show Ban at Texas College

- Upto $35K Assistance for Oklahoma Homeowners Affected by COVID-19

- Urgent Call for Social Security Fix as Seniors Face Shocking Bills

This potential stimulus check for shoppers could play a role in boosting local economies and aiding struggling businesses. Stay tuned for updates on its progress through the legislative process.

+ There are no comments

Add yours